Owning property within urban Bangalore has traditionally been considered a sign of stability and a prelude to wealth. Pre-2000, urban clusters such as the CBD (Central Business District) area, Sadashivanagar/RMV-Layout (North B’lr), Indiranagar (East B’lr), Rajajinagar (West B’lr) and Jayanagar/Koramangala (South B’lr) still command premium value. The subsequent IT-boom and its aftermath brought about high demand micro-markets like Whitefield, Sarjapur, Electronic-City, etc.

Since its enactment, the Karnataka Land Reforms (Second Amendment) Act of 2020, has significantly influenced the transition of farmland margins into emerging agro-residential corridors across the Bengaluru(Rural) landscape. In this context, the Nandi-Hills / Devanahalli corridor stands-out as a prominent nodal cluster

Here’s why property-investments in the Nandi-Hills area are expected to outperform those in urban-Bengaluru:

1. Urban-Bengaluru’s Slowing Growth

Urban Bengaluru’s property prices have largely peaked and stabilized, driven by demand pushing valuations to their limits. Compounding this, the city’s space and infrastructure constraints have resulted in a marked reduction in new developments.

- The Urban Price Stall: Property prices in urban Bengaluru have largely peaked and stabilised. Subsequent price movements shaped by the wider market dynamics of the Greater Bengaluru Region; tend to offer modest (and secure) returns.

- Space Constraints: The shortage of open land in urban Bengaluru; alongside widespread construction guideline breaches and ongoing infrastructural strains has resulted in a subdued environment for new project-launches.

- No New Infrastructure Catalysts in Sight: The city already has in-service / under-construction and proposed / approved roads, metro, and other infra-facilities. Most major infra-developments are either done or underway.

- Lifestyle Limitations: Professionals and investors are increasingly distancing themselves from the traffic congestion, pollution, and lack of open spaces that define urban Bengaluru. With WFH culture gaining permanence and connectivity improving, (peripheral) rural Bengaluru now presents property choices with lifestyle advantages that the city can no longer provide

2. Why the Nandi-Hills/Devanahalli corridor is experiencing accelerated growth

The Nandi Hills–Devanahalli corridor, located beyond North Bengaluru, is witnessing accelerated growth driven by large-scale, expansion-oriented infrastructure. Ongoing investments are reshaping mobility, employment zones, and land-use patterns in the region. Unlike urban Bengaluru, where infrastructure is largely incremental, this corridor is still in a transformational phase. As a result, real-estate values here are responding to future potential rather than past saturation. This structural advantage positions the corridor for stronger growth momentum than mature urban markets.

1. Kempegowda International Airport and nearby Business Hubs: The Kempegowda International Airport is the single most powerful growth catalyst for the Nandi Hills–Devanahalli corridor. Its proximity has structurally reoriented the region from a peripheral zone into a strategic employment and logistics hub, embedding long-term value into surrounding land and residential markets.

Large-scale developments such as the Devanahalli Business Park and the KIADB Aerospace Park are attracting global aerospace, manufacturing, and technology firms. These clusters are generating sustained white-collar employment, driving demand for high-quality housing within short commute distances, an advantage Nandi Hills uniquely offers.

According to a report by Hindustan Times, land and property values around Devanahalli have already appreciated by 30–35% following Foxconn’s announced investment and ongoing facility development. This influx of jobs and skilled professionals is translating directly into rising residential absorption and reinforcing the corridor’s growth trajectory.

2. Namma Metro Blue Line Extension as a corridor-wide catalyst: The Namma Metro Blue Line extension, expected to be operational by December 2027, will directly connect Silk Board Junction in South Bengaluru to Kempegowda International Airport. This marks a decisive shift in how North Bengaluru and its peripheral regions integrate with the city’s economic core.

While positioned as an airport link, the metro’s real impact lies in compressing travel times across urban and suburban North Bengaluru, improving daily commute viability. Historically, metro connectivity has acted as a strong price catalyst, and this extension is likely to re-rate land and residential values across the entire Nandi Hills–Devanahalli corridor, not just at station nodes.

3. The Satellite Town Ring Road (STRR): A Structural Game-Changer The Satellite Town Ring Road (STRR) is a 288-km regional connectivity project designed to link Bengaluru’s peripheral towns while integrating six National Highways into a single high-capacity network. Unlike city roads, STRR is expansion-oriented infrastructure, aimed at decentralising growth and unlocking new economic corridors. Passing close to Nandi Hills, STRR provides seamless connectivity to nodes such as Devanahalli and Hoskote. Land and property values along STRR-linked zones have already begun responding, with further appreciation expected as project milestones are completed.

This connectivity upgrade elevates Nandi Hills from a peripheral, lifestyle-driven destination into an integral component of Bengaluru’s expanding economic and residential geography, materially strengthening its long-term real-estate outlook.

3. Land Price and Growth Comparison

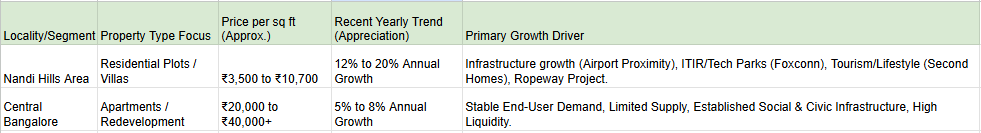

Data shows that the North Bangalore corridor, including the Nandi Hills area, has a stronger price growth potential than the core city.

Strong growth history: As per research shared by The Financial Express, Nandi Hills saw around 11.7% yearly price growth between 2015 and 2020. Infact, in the premium segment, prices rose by almost 350% over 12 years (2010 to 2022).

Lower base price advantage: Land past North Bangalore costs much less than land within the city. Because of the lower starting point, even a 15–20% increase is easier and more realistic. This means the percentage gains can be much higher than what city can offer.

4. The Lifestyle Advantage: Why Quality of Life Matters

After the pandemic, many buyers now care more about space, clean surroundings and a healthier lifestyle. City chaos cannot offer this in the same way.

1. Weekend home appeal: Nandi Hills is just about a 90-minute drive from the city, making it a perfect weekend getaway. This gives the property both emotional value for personal use and financial value as an investment.

2. Clean air and peace: Buyers increasingly want homes away from traffic, noise and pollution. This demand is not temporary. It’s a lasting shift in buyer preferences. This “green appeal” attracts HNIs, NRIs and esteemed retirees who want a better quality of life and a premium view of nature.

3. Tourism development: As per The Financial Express, the Karnataka tourism department has taken charge of upgrading Nandi Hills with projects like a 2.9 km ropeway and improved trekking routes. These investments will keep the area attractive to visitors and boost demand for second homes and short-term vacation stays.

Conclusion

Investment in Bangalore city helps preserve wealth, while investment in Nandi Hills accelerates it. With major infrastructure, rising economic activity, and a stronger lifestyle appeal, this region is shifting from a weekend spot to a high-growth investment zone.

Triguna Country Homes, which has already won the Farmland Project of the Year 2025, is now preparing to launch another signature luxury gated farmland community in the Nandi Hills corridor. They bring the same quality, trust, and thoughtful development that earned them recognition across the industry.

For smart investors, the direction is clear. Nandi Hills is a place where you enjoy nature today and build value for tomorrow.